Markets Now - Wednesday 9th September

Simply sign up to the Equities myFT Digest -- delivered directly to your inbox.

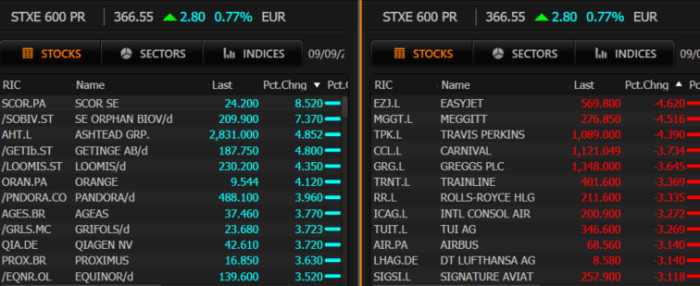

Turning and turning in the widening gyre, the FTSE 100’s up nearly 1 per cent. The best lack all conviction, while the worst are full of passionate intensity, and you’ll be hearing from them both over the next 5,000 or thereabouts words. Scoreboards to begin:

AstraZeneca caused some lively headlines overnight with news that it’s paused recruitment for its Covid-19 vaccine trial after a single adverse event. Shares went 8 per cent down in the reliably skittish US aftermarket but have since recovered as qualified people said this kind of thing happens all the time. The bigger question relates to whether anyone should be investing in AZN on the expectation that its Covid vaccine candidate will do a Maradona run all the way to FDA approval, not least because there’s probably negligible financial value of being first to market. Here’s Jefferies with a comprehensive overview:

Media reports case of transverse myelitis: The NY Times reports that a volunteer in the UK trial received a diagnosis of transverse myelitis, an inflammatory syndrome that affects the spinal cord. AstraZeneca has said the pause is a routine action which has to happen whenever there is a potentially unexplained illness in a trial. It added that it is working to expedite the review of the single event to minimise any potential impact on the trial timeline.

Expert we spoke with noted AAV vaccine safety track record: An expert we spoke with after the publication of Phase I/II data from the COV001 study of AZD1222 thought the safety profile of AZD1222 up to that point compared favourably to the tolerability of mRNA vaccines. The expert noted that for adenovirus (AAV) vaccines, there was a substantial and “enviable” safety dataset amassed from immunising US troops over the past 60 years. This, of course, does not mean new adverse events could not emerge with a novel vaccine, perhaps as an autoimmune response to the chimpanzee adenovirus vector used. As expected, AstraZeneca is treating the emergence of a severe adverse event (AE) in the Phase III study with appropriate and warranted caution.

Initial Phase I/II efficacy data encouraging: Results from the Phase I/II COV001 study of AZD1222 indicate that the vaccine is immunogenic with antibody responses in 95% of subjects peaking by day-28 at levels around convalescent plasma samples, and remaining elevated to day-56. Neutralising antibodies were measured in 91% of 35 assessed participants, with PRNT-50 median titre 218 broadly similar to the median of convalescent plasma. All participants had marked increases in effector T-cells. A 2-dose regimen boosted antibody titres, not T-cells, and is under further investigation. There were no vaccine related serious adverse events in the Phase I/II study and prophylactic paracetamol reduced pain and fever.

Commercial opportunity challenging to quantify: AZN has committed to providing AZD1222 at no profit during the COVID-19 pandemic. There may be a future commercial opportunity if re-vaccination is required, and viable with this vaccine construct, and/or the birth cohort is at risk; likely dependent on the duration of immunity and whether subsequent “waves” occur. Our back-of-the-envelope $1.5bn WW recurring sales for AZN assumes 250m doses p.a. for developed countries at c.$6 per dose, a discount to estimated US flu vaccine revenue/dose around $11-13 given likely national tenders, government upfront support, and lower-priced geographies. We do not currently include sales or ascribe an NPV to AZD1222 given uncertainties, but our assumptions imply c.250p/share (3%).

And JP Morgan Cazenove:

We hesitate to over-interpret the impact of this afternoon’s news of a clinical hold on AstraZeneca / Oxford’s Phase 3 trial on the rest of the COVID-19 vaccine (or therapeutic) field. This move was apparently made out of an abundance of caution following an unexplained serious adverse event in a single subject in the UK. Beyond that there are zero details, and, as such, read through to other programs is extremely limited. In our view, this news does little to change the probability of success of other vaccine candidates or the competitiveness of the market (recall that there are nearly 200 vaccine candidates in development, including a handful in later stages). Where we’re concerned is how this could damage the public perception of vaccine safety. While it is true that an AZD1222 delay could increase MRNA’s and BNTX’s odds of winning the so-called “race to the COVID-19 vaccine finish line,” we think this adds little fundamental value as a vaccine’s ultimate clinical profile should trump any first-mover advantage in what we still anticipate to be a competitive market.

And Barclays:

While the AstraZeneca U.S. study had only recently opened, the vaccine had been administered to >15K volunteers, providing some context – although drawing broader conclusions on a n=1 is challenging. Transverse myelitis is rare, but not unheard of (affecting 1 in ~250K in the U.S.) – and this may ultimately be a one-off event, rather than a broader safety signal. We expect this event and outcomes from AstraZeneca’s safety review to receive significant attention at the next scheduled Advisory Committee meeting to discuss COVID-19 vaccines on October 22.

What Does This Mean for Pfizer’s Vaccine? Potentially Nothing, Potentially an Incremental Positive. It’s too early to make definitive comments, although we note Pfizer/BioNTech’s and Moderna’s (covered by Gena Wang) approach are mRNA-based (and together they have vaccinated >45K volunteers without reported cases), while AstraZeneca leveraged Oxford’s adenovirus vector platform. Given the number of volunteers vaccinated with other approaches targeting the spike protein and the absence of reports of transverse myelitis, we think it unlikely of a broader signal dooming targeting the spike protein. Potential removal of AstraZeneca from the COVID-19 vaccine front (it’s far too early to draw that conclusion) could ease some of the evolving competition, but we’ve been less concerned about AstraZeneca as a competitive rival to Pfizer based on the early biomarker data.

Does the Regulatory Hurdle Move Highly? The unorthodox Joint Safety Pledge announced Tuesday morning from the COVID-19 vaccine developers looks particularly well-timed in light of tonight’s update. Further updates from AstraZeneca on the patient and the vaccine may provide greater context, ultimately downshifting concern – but that remains to be seen. Ironically, while AstraZeneca appears to have acted quickly and prudently, tonight’s update still provides a high-profile negative headline for an FDA and industry looking to reassure the U.S. public around the safety of the vaccines rapidly moving through development. Further, it begs the question if the balance between safety and speed shifts incrementally to the former, potentially reducing the chances of quick EUA turnaround ahead of the election for the leading developers – a point which some (e.g. Dr. Anthony Fauci) have downplayed in recent days.

Okay, fine. But the Stat report that broke news of AZN’s trial pause quotes a second source as saying (our emphasis) that “the finding is having an impact on other AstraZeneca vaccine trials underway — as well as on the clinical trials being conducted by other vaccine manufacturers.” That line’s a bit of a worry for all other developers. One adverse event really does have the potential to sink all boats.

SVB Leerink, the specialist healthcare investment bank with a very good research department, runs through four possibilities. The first -- that the spine thing is all unrelated to AZN/Oxford -- is self explanatory so we’ll cut to the other three possibilities, which SVB offers unweighted:

• Scenario 2: Transverse myelitis is limited to AZN platform or vector. If TM turns out to be platform or vector related, the AZN program will likely be terminated and other products with a similar foundation (adenovirus vaccines, such as JNJ [OP], CanSino) will likely be under increased scrutiny that could lead to termination if TM is noted in the respective databases.

• Scenario 3: Transverse myelitis is related to homology between SARS COV2 S epitope and a component related to the myelin sheath. In this scenario, the SARS COV2 S epitope that is targeted by vaccines induces an immune response that is homologous to a component related to the myelin sheath, causing inadvertent, direct autoimmunity mediated damage. This could have much broader implications for many of the vaccines in development, which target the same component of the SARS COV2 spike protein.

• Scenario 4: Transverse myelitis is related to collateral damage from the immune system attack of the virus. In this scenario, vaccine mediated immune responses attack the virus, and the inflammatory response causes collateral, indirect damage to the immune system. This scenario, like Scenario 3, could have broad implications for many of the vaccine programs.

But of course, hype-powered Covid moonshot Moderna is rallying about 4 per cent premarket on AstraZeneca’s news, having slumped more than 13 per cent in Tuesday’s session. Two things happened to trigger that fall. The first was the news that Stephane Bancel, Moderna’s chief executive, expressed his optimism by taking $683,459 off the table with yet more share sales. The second was that SVB Leerink advised a sell.

Based on a capacity buildout equivalent to a global Manhattan Project for vaccines and clarity on competitive pressure in the SARS-CoV-2 vaccine market, we are downgrading MRNA to Underperform from Market Perform and lowering our PT to $41. Recent developments - loss of mRNA-1273’s lead in clinical development, extension of multiple large volume COVID-19 vaccine contracts to competitors, risk of reduced end-user demand due to increased skepticism for vaccines rushed to market under EUA – make a durable market with oligopoly pricing unlikely. Probability of EUA for mRNA-1273 in 4Q20 is high, but speed to market has fallen behind competitors (note HERE), and we are no longer able to find an avenue to confidently predict beats vs 2021 estimates even with aggressive assumptions. While longer-term estimates have started to rationalize from the highs this summer, they remain inflated. This rerating of consensus has been accompanied by heightened headline risk with increasing media scrutiny of aggressive management stock sales. As the Street digests the changing competitive environment, we believe shares will continue to face pressure ahead of presumptive EUA and first commercial sales this winter.

Elsewhere . . . . Tiffany’s the big mover over the past hour after LVMH pulled out of the $16.2bn takeover, claiming the jeweller breached transaction obligations. Tiffany denies, having earlier indicated that it was taking LVMH to court to push the deal though. Shares in Tiffany are down about 9 per cent at pixel.

UK pub operators and so forth are down on the England policy shift to cut the cap on social gatherings from 30 to six, except when there’s a till present. Pubs and restaurants can still host as many customers as they choose and there’s the necessary carve-out for schools, workplaces, etc. The worry here though is that it’s a boiling frog policy as we move towards another round of big city lockdowns before the end of the month. JD Wetherspoon and Cineworld are suffering, as are the retail and travel names like SSP and WH Smith.

Coincidentally, Berenberg has a big leisure sector initiation out that mostly uses a rear-view mirror for Covid. Its three big calls are:

The growth play – Trainline (Buy, PT GBp520) – down 23% ytd: 1) We believe Trainline has a 70-75% share of its addressable market in the UK and its barriers to entry are insurmountable. 2) As the UK’s online penetration grows from just over 40% at present towards 70%, we believe the UK business alone could almost treble Trainline’s group earnings from 2019 levels. 3) While its market share is much smaller in Europe, it is already the leading third-party platform, and should stand to benefit as European rail markets a) move online, and b) liberalise, causing fragmentation of existing state-run services. Trainline currently trades at 31.6x February 2023E P/E (or 26x excluding international losses).

● The value play – National Express (Buy, PT GBp190) – down 73% ytd: 1) National Express is a best-in-class operator with strong ESG credentials, evidenced by a five-year TSR of over 130% pre-COVID-19 (c18% CAGR), comfortably outperforming both peers and the FTSE250. 2) Its operations have greater resilience than may be perceived, with the business remaining EBITDA-profitable even in Q2. 3) We believe it can weather this crisis, and over the medium term, it still has a number of attractive avenues for continued growth. National Express currently trades at 4.3x December 2022E P/E.

● The longer recovery – WH Smith (Hold, PT GBp1,200) – down 51% ytd: 1) WH Smith has rightfully won plaudits for keeping earnings in its legacy High Street business broadly flat over the years, despite declining sales. However, we think that this is becoming increasingly difficult, and is exacerbated by COVID-19. 2) Over that period, travel has become the engine for growth, and now makes up over 70% of the business. While travel still has a sizeable opportunity in the long run, we think that air in particular (which represents the majority of the company’s travel business) could take years to recover to 2019 levels. WH Smith currently trades at 28x 2022E P/E, though that falls to c16x in 2023E.

Avon Rubber, a company built on the west of England’s enthusiasm for vulcanisation, is leading the FTSE 250 gainers. It’s bought Team Wendy, a US company that makes helmets, for $130m. It’s Avon’s second big purchase in 12 months, following the Ceradyne buy last year, which followed the sale of its milking equipment division.

Stifel likes:

The company has agreed to pay a cash consideration of $130m on a cash and debt-free basis, which equates to c.2.9x 2019 revenues and c.9.7x EBITDA 2019 EBITDA.

Deal timing: The acquisition constitutes a Class 1 transaction, under FCA rules, and as such is dependent on shareholder approval at a general meeting at the end of September. Completion is expected in Q1 FY21 following shareholder and U.S. regulatory approvals (CFIUS and HSR).

Deal financing: With expected deal costs of £8m, the deal will be financed from the agreement to divest milkrite | InterPuls. A new 3- year RCF facility of $200m, with two 1-year extension options, is in place as a bridging facility should Team Wendy close ahead of the dairy sale but also could support future growth. Avon expects the acquisition to be EPS enhancing and deliver a return on investment ahead of our WACC within 2 years of ownership. Also, the group expects to return to a net cash position following completion of both transactions.

Team Wendy: Single facility in Cleveland, Ohio, with approximately 130 employees. Excellent R&D capabilities with a leading focus on helmet liner and retention systems and impact protection capabilities. 2019 Revenues of $44.2m, (61% in the US, 39% ROW) (81% Military, 19% First Responder), and 2019 EBITDA of $13.4m and EBITDA margin of 30.3%. Acquired assets are expected to be c. $20m.

Current trading: For the core business, H2 trading continues in line with expectations and the company remains confident on delivering on the FY expectations for continuing operations.

Stifel view: Avon has partly answered the “What’s next?” question on the M&A front following the decision to exit milkrite I InterPuls in July for £180m. Deal multiples look a little rich but in a strong sector, and the business is both complementary and builds global reach. Moving to US dollar reporting also seems sensible, given the future bias of the business. Recent order newsflow has been encouraging, and we welcome the statement that continuing operations are trading in line with expectations. Overall, interleaving acquisitions and disposals is no mean feat, and we admire Avon’s strategy here.

Among the day’s sellside, The Hut Group gets a pre-IPO write-up from Liberum, which is one of the very few brokerages not on the ticket for its £4.5bn/£920m float. Not unreasonably given the tilt of recent coverage, it focuses almost exclusively on the operational positives:

THG is a unique play being a brand builder and a leading technology provider in the UK, giving investors exposure to high structural growth. The online Beauty and Nutrition markets in which THG operate, are growing at 10% to 14% p.a. respectively, but given THG’s proven disruptive credentials driven by the power of its technology backbone, it should achieve a 20-25% sales CAGR FY19-24E. The success of the group is underpinned by technology that is not only driving the core business, but now through a SaaS offering, provides high margin (c.60% EBITDA margins), high growth (c.40% sales CAGR) and significant visibility and sustainability in earnings. The IPO is a proposed fixed price deal (c.£5.4bn post new money) valuing THG at 3.8x CY’20 sales, but on a post IPO basis, we see a valuation range of £7bn to £7.5bn as achievable.

Yep! £7bn+. And that’s the conservative view. Here’s the working:

Peer group valuation: CY’20 -21 valuation range of £7bn-£7.2bn. However an argument could be made that Ocado (n/r), which is valued at an equity value of £16.9bn (EV of £17.36bn) and trading on an EV/sales of 6.7x CY’21 is a relevant comparative and one that is listed in the UK. A similar multiple would suggest a £11.8bn EV. ...

Our DCF suggests a fair value of £7.4bn equity value. We are forecasting a net cash position of £214m by Dec’20 meaning we are using a cost of equity for our WACC of 8.5%; Terminal growth rate of 5% driven significantly by the opportunity provided by THG ingenuity

So . . . . . . . the upshot is that THG Ingenuity, the “proprietary technology platform and operating ecosystem, providing end-to-end direct-to-consumer platform under a Software as a Service model” (14 per cent of 2020 revenue), is “ahead of many of its peers from a technology perspective”. That’s what “differentiates the business from its competitors”:

Having only started to sell its SaaS services in 2018, the group has significant growth opportunity from its current client base as well as winning new business where THG has seen an accelerating run-rate of client wins of over c.£200m YTD. Ingenuity’s revenue model is built up across distinct technology, operational and brand building services. We believe Ingenuity’s end-to-end capabilities (eCommerce in a box) provides greater revenue upside as the THG solution takes responsibility for delivering sales success. Traditional service providers require continued new customer acquisition to drive sales growth, and this requires large marketing budgets to support the acquisition of new clients. By contrast, THG’s approach is to charge lower upfront fees, but to capture a much greater share of the upside through long-term revenue share agreements, which align THG’s and the brand owner’s interest.

It’d be very impressive if THG Ingenuity is already ahead of SaaS storefront vendors like Shopify (founded 2006), Magento (founded 2008), Volusion (founded 1999) and SAP (founded 1972). Prospective investors might need to do a wee bit of DD on the “if” though.

Liberum also offers some celebration of Hut’s unfashionably asset-heavy operating model:

THG currently manufactures approximately 57% of Beauty Own Brand products, and 80% of Myprotein products across four production facilities. In-house product development and manufacturing support enhanced margins and reduced development timelines for new product innovation. The group operates across 29 owned / controlled data centres in the UK, EU, US and Asia Pacific, in addition to hosting 10,000+ 3rd parties including pre-eminent technology brands. THG operates from 9 distribution centres (3 million sq. ft.), located in the UK, EU, US and Asia Pacific. This network supports same day, next day or 2-day delivery service across every territory globally and serves to meet the demand of its own websites as well as SaaS clients

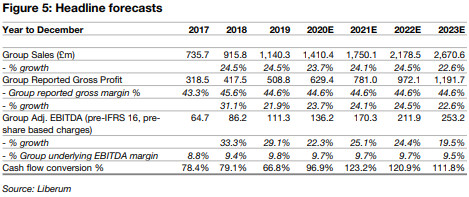

And there’s an unscientific stab at forecasts using Hut’s target of 20 to 25 per cent long-term revenue growth (Beauty, Nutrition and Ingenuity at 25 per cent, 20 per cent and 40 per cent respectively) with gross margins holding steady at around 44 per cent:

And sure, okay, why not. Some people might quibble with the idea that 44 per cent gross margin is sustainable from THG Beauty (42 per cent of 2019 revenue), the cosmetics operations that use a Sports Direct type model of pulling people in with third-party brands they recognise then selling them own-label brands they don’t. Similar arguments can be made about Nutrition (36 per cent of 2019 revenue), which is mostly Myprotein, its 2011 acquisition that had a headline value of £58m and ended up in court on charges of juiced figures stemming from what the judge called “an atmosphere within the finance department which allowed fraud to flourish.”

Hut estimates that MyProtein has 2019 market shares in the UK and Western Europe of 15 per cent and 13 per cent respectively, with nearly all its sales direct to consumer. It’s a very crowded market though, with D2C not really much of a USP, and it’s not immediately obvious whether extensions such as a tie-in clothes range add significantly to the revenue number. (You’d probably assume it doesn’t, as the market for people who want the brand of a bulk powder on their chest ought to be quite small, but fashion is odd.) What’s a sustainable margin there? And what’s the sustainable margin from the ragbag of stuff that Hut’s collected over the years, such as its Manchester hotels and its second-hand auction website (11 per cent of 2019 revenue)? It feels a bit heroic to be valuing any of this stuff on an Ocado multiple rather than, for example, a Granada multiple.

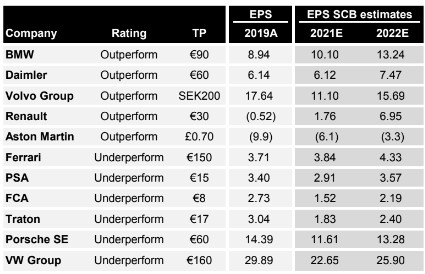

On the subject of heroic calls . . . . Bernstein, the Aston Martin of brokerages, starts Aston Martin with an “outperform” and 70p target as part of a gigantic autos sector note. Everything’s either a buy or a sell, refreshingly:

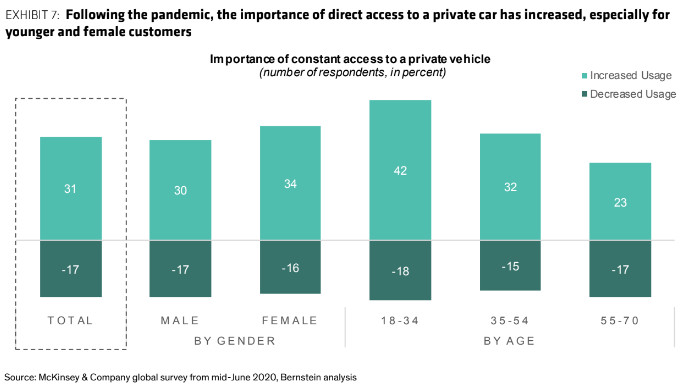

The overarching thesis is that cars won’t be going anywhere. Surveys both pre and post Covid make it “strikingly obvious that consumers intend to reduce the amount of public transport they use and replace it overwhelmingly with a private car,” says Bernstein. We’re all getting more sceptical about public transport and car sharing in its various forms, plus there’s the staycation thing and the escape-to-the-country thing, meaning everyone wants a car.

Cars, you’ve probably noticed, have been quite popular for a while so even small changes in behaviour and demographics will move the dial for the automakers, Bernstein says:

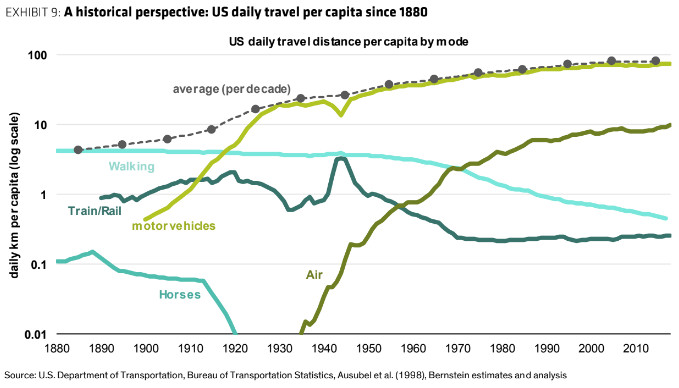

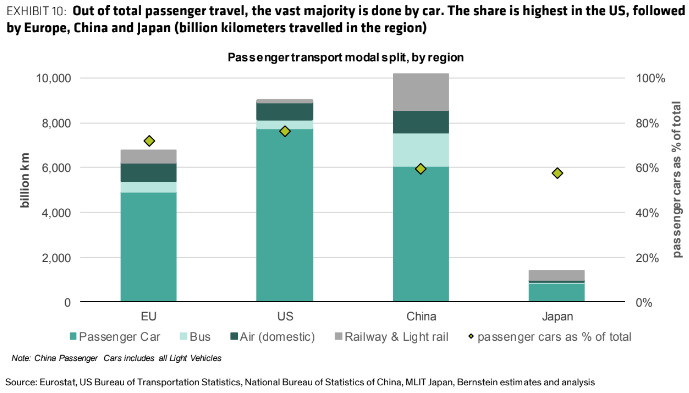

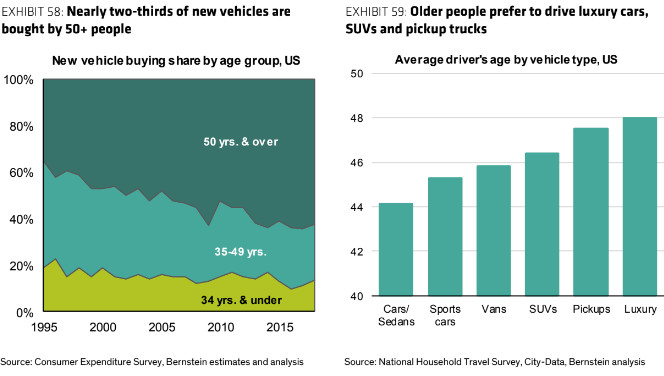

With 21tn kms travelled in cars p.a., and about 70% of the EU’s passenger travel done by car (US 77%, China 60%), small changes in the modal split of transportation have material implications for new vehicle sales. The rise of air travel in the last 30 years has been at the expense of passenger cars. . . . Assuming the modal share of passenger car travel increases slightly, scrapping rates and vehicle miles travelled stay within their long-term ranges, vehicle sales will materially increase. Simply speaking, people will fly less, use less public transport and will drive more. It’s also vital to understand that the aging population is great news for vehicle demand, especially premium brands.

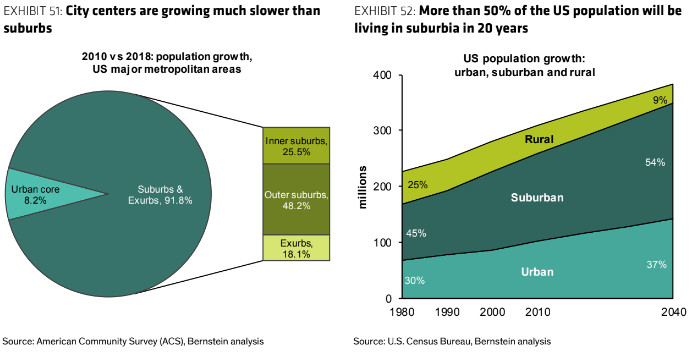

Electric’s not really a threat to most manufacturers, nor is autonomous, because in comparative terms Tesla’s no big whoop. Uber’s scuppered by the move to suburbia. Car companies have been woeful at investment (“The car industry’s future investments carry almost no value. For Europe, where the auto industry accounts for a stunning 31 per cent of all R&D spending, this is a shocking message”) but with the damage already done things can and probably will improve. Ditto cashflow. Everyone’s much too negative, Bernstein says:

Vehicle demand will recover much faster than currently forecasted. Earnings and cash flows will recover faster with some companies being back at their pre-COVID earnings level already in 2021. Our estimates for key Outperform-rated stocks are 30-60% above consensus forecasts We forecast global passenger car volumes of 75mn/80mn for 2021/22 which stands 7% above consensus and brings 2022 global volumes back to the level of 2019. We understand that the secular demand drivers from an increased share of personal miles driven need to be weighed against the near-term macro headwinds. We believe that our forecasts are a balanced reflection of these secular tailwinds and cyclical/macro headwinds.

Contact your friendly Bernstein representative for the full 225 pages. In recommendation terms it advises to buy cheap stocks and fugly marques. “Forget young people -- the older buyer is where the money’s at”, Bernstein concludes. Here’s the Aston writeup:

It’s not saying anything original to describe Aston Martin’s IPO and time as a public company as a disaster: the stock is down a brutal ~90% from its IPO price (adjusting for the rights issue) – mainly due to its unrealistically optimistic starting point and an unsuitable capital structure, without sufficient cash to survive setbacks or to fund its ambitious product plan.

The market’s perceptions of this company have been dramatically reset since the IPO. At the time of the float, Aston’s bankers pitched it as a flawless diamond, ready to take its place in the top tier of luxury brand stocks. It was totally over the top, and dangerously ambitious. The reality – that it’s a great brand but one that doesn’t have an endless queue of potential customers (at least not yet) – has now become clearer. The fact that it’s a loss-making company in real terms, with a fragile balance sheet and with inventory issues, has also now been recognized. With better informed participants in the financial markets, this new realism also provides an opportunity.

A new management team, with a background in premium/niche car manufacturing and experience in turnaround of luxury brands, has moved quickly to bolster the balance sheet that should be able to withstand pressure in the next 12-24 months, even if DBX volumes are lower than expected. A restructuring plan has also been put in place – but it needs to deliver and achieve lasting cost savings. More importantly, the Aston Martin DBX, arguably the most critical product in the company’s 107- year-old history, is finally here and has the potential to catapult the company and its finances to an entirely new level.

Ferrari’s on a sell though, in part on the Purosangue SUV, which is a looks like a Masda MX5 that’s been at the MyProtein powders

The simple narrative around Ferrari goes something like this: “amazing brand, limited supply, waiting lists, sells to the rich, number of HNWIs growing, easy to grow profits”. The reality is a bit more complicated. Ferrari’s product range and success is patchier than realized. Ferrari already has 60% share of 2-seat sports cars >$250k, and that market isn’t growing much.

Ferrari’s unit volume growth in the more profitable areas is going to be fairly limited, in our view – due to the small overall growth rates in sports cars globally as well as by the lack of obvious segments it can enter (beyond what’s already announced) without damaging its brand. The Purosangue SUV (or “FUV”) offers some growth, but also carries engineering complexity, brand risk, residual value challenges and product cycle volatility. We worry that Ferrari is moving too fast and too aggressively with its growth. The Purosangue does very little to protect the brand’s exclusivity status – in fact, it may end up hurting it instead. At some point, it may become clearer that Ferrari’s ability to move upmarket and raise prices has limits.

Over at Citigroup they’re turning positive on Pandora, the Danish charm bracelet retailer:

We upgrade Pandora to Buy given: 1) our greater confidence on a material LFL improvement from FY21E onwards, driven by stronger brand heat metrics and full-price sales mix; this should in turn drive improved earnings momentum albeit we do not expect medium-term EBIT margins to surpass ~23%, with capped gross margin and cost inflation; 2) sustainability of capital returns through buybacks and dividends (~6-8% historical yield equivalent), after a ‘gap’ year; and 3) supportive valuation for a ~20%+ EBIT margin business (~13x FY22E P/E).

Raising medium-term forecasts, now ~5% above consensus

Adjusted EBIT/EPS reduced by ~10% in FY20E but raised by ~10-15% in FY21E on stronger top-line. We turn more positive on the medium-term sales/earnings trajectory given credible signs of turnaround and raise our FY22-24E adj. EBIT/EPS by ~15% each year. This drives a 3-year (2021-24E) sales/adj. EBIT/EPS CAGR of 5%/7%/8% respectively incl. mid-single digit LFL, ~75% gross margin, low single-digit opex growth, ~23% EBIT margin (~400bp below FY19) and ~DKK3.5bn FCF p.a.(post leases). This should support the stock’s income profile with continued capital returns (buybacks/dividends). We are 3% above cons. in FY22E; ~5% above in FY23/FY24E.

15% upside to FY24E EBIT on our Bull case

We provide EBIT margin sensitivity to various sales and opex growth assumptions. On our Bull case (stronger than expected LFL), Pandora could achieve ~25% EBIT margin by FY24E (vs. base case of ~23% and FY19 ~27%).

TP raised to DKK570

Pandora’s stellar share performance YTD (+60% vs. luxury sector -8% and DJ Eurostoxx -12%) and ~80-90% re-rating have been supported by early signs of LFL improvement, upside risks to medium-forecasts as well as CEO recently buying shares well in excess of his contractual obligations, we think. Management’s strong focus on brand execution, cost control and our positive brand heat tracker analysis give us confidence in our forecasts. Our DCF valuation points to DKK570 fair value (implying FY22E P/E of ~15x). Key risks - 1) Charms category fatigue; 2) Brand momentum fading once A&P investments normalise; 3) Gross margin pressures (silver); and 4) Rising cost of doing business (rents, wages, A&P).

• Updates might follow, influenced or otherwise by requests and complaints in the comment box.

Comments