Markets Now - Monday 29th June 2020

Simply sign up to the Equities myFT Digest -- delivered directly to your inbox.

Summertime, and the villain is squeezy:

Wirecard’s more than doubled after Frankfurter Allgemeine Zeitung reported that Worldline of France might seek to buy some bits. Also, Wirecard said over the weekend that filing for insolvency wasn’t going to stop it proceeding with business activities (except in the UK, where the FCA’s frozen the local subsidiary and left a bunch of people reliant on prepaid cards to starve).

The share price, meanwhile, can only really be explained by a short squeeze. Since Wirecard collapsed owing nearly $4bn to creditors it’s not immediately obvious how any disposal could justify an at-pixel market cap of €382m. Neither is it totally clear why Wirecard shares are even continuing to trade in Frankfurt when the core operations are so murky it’s no longer allowed to provide services in the UK. They do things different in Germany though:

The government will terminate its contract with the country’s accounting watchdog, the Financial Reporting Enforcement Panel, as early as Monday, according to officials briefed on the matter.

The power to launch investigations into companies’ financial reporting would then be handed to BaFin, Germany’s financial regulator, the officials said.

Great stuff.

Elsewhere in the weekend press, Drax is up after the Mail on Sunday’s Jamie Nimmo said there were “rumours circulating around the Square Mile that a takeover could be on the cards”. It was for quite a long time a story exclusive to newsagents and their customers. The article didn’t make it onto the MailOnline website and a Bloomberg pickup this morning caused no end of confusion by giving credit instead to the Sunday Mail, the sister paper of Scottish tabloid the Daily Record.

Anyway. The MoS says an “unknown energy company has got its eye” on the power station owner and “could even be in early stage talks” with “chatter that talks focused at 340p a share.”

There isn’t a lot to go on. No named bidder is a big hurdle to shaking out confirmation and, in that context, no response from Drax this morning means nothing much. The UK Takeover Code will, in the absence of a formal offer, put the initial burden of announcing on the bidder side so we’re chasing shadows in that regard. Nevertheless, there has been very credible talk over the past week of a UK mid-market deal in the works and Drax would definitely fit the description. Here’s John Musk, analyst at RBC:

We note that within our 340p/sh PT ~85% of the Drax EV sits within renewable biomass and hydro activities. Hence, Drax could be justified as a takeover for some of the larger renewable exposed utilities with the likes of RWE, Enel and Engie all potential suitors, in our view, given their renewable expansion plans, asset overlaps and relatively robust balance sheets. We note Iberdrola sold Drax its Hydro and CCGTs assets in the UK 18 months ago and is unlikely to buy these back, and SSE does not have the balance sheet for this potential transaction.

In our recent renewables report we reiterated our Outperform rating on Drax highlighting that we remain supportive of its biomass cost reduction strategy in order to be self-sufficient post the end of the subsidy period in 2027. Furthermore, we stated that we see Drax’s green credentials as unappreciated, with the company not experiencing a re-rating like many renewables peers. . . . UK pumped storage assets (such as Drax’s 440MW Cruachan facility) are performing robustly during the Covid-19 crisis and this could provide some offsets to the previously highlighted £60m EBITDA hit from Covid-19 in 2020. Finally we continue to highlight the strong FCF generation of the company, and the well covered ‘sustainable and progressive’ ~7% dividend yield.

We note that our 340p/sh price target is based upon the current business only with no biomass generation post 2027, no new CCGTs or peakers and no BECCS. If any bid were forthcoming we believe some option value would need to be ascribed for these projects and highlight our Blue Sky valuation of 545p/sh.

Over in corporate, BP’s sold a big chunk of petrochemicals business to Ineos for $5bn. That’s BP hit its $15bn disposal target one year ahead of plan, which leaves it looking a bit less like an oil company. What a stronger balance sheet means for the dividend largely depends on how fast CEO Bernard Looney wants it to look even less like an oil company; surprise disposals of core divisions definitely carry the sense that he’s in a hurry. Here’s Berenberg:

While we think it remains more likely than not that BP will look to cut the dividend at Q2, this sale keeps alive the possibility that the company could retain the existing dividend, or cut by less than the market currently expects, in the hope that a recovering environment enables the company to organically cover its dividend commitments again in 2021. A dividend cut would free up capital to help pivot the business more quickly in the energy transition. This sale demonstrates that the new management team at BP remains committed to delivering on its new strategy, which will involve material changes to the business over the coming years.

And Credit Suisse:

Whilst the full exit does come as a surprise, BP’s Petchem business is relatively less integrated than its peers (i.e., limited overlap with the rest of the company). Additionally, it requires significant capital to grow the business, and we believe the business was not attracting the capital that it needed. With this announcement, BP has not provided an update on the disposal plan - i.e., whether or not it will increase the target now that it has completed (in terms of announcement) the $15bn disposal plan, originally targeted for mid-2021 (i.e., delivered one year earlier than planned). Unlike the Hilcorp deals, the cash proceeds will be received much faster, which is a positive. Ineos, which can be active in M&A during downturns, will pay BP a deposit of $400m and will pay a further $3.6bn on completion, which BP expects by year end. An additional $1bn will be deferred and paid in three separate instalments of $100m in March, April and May 2021 with the remaining $700nm payable by the end of June 2021. The company stated that the average EBITDA for this Petchem Business over the period 2016-19 was $600-700m.

BP has been busy of late - in mid February, BP’s new CEO announced his 2050 ambitions for the company and his new leadership team to help him get the ball rolling. More recently, the company then announced a significant restructuring which will see ~15% of its workforce cut this year (with potentially more to come for the period beyond). Subsequently, the company announced that it would take a $13-17.5bn (post-tax) impairment charge with 2Q20 results following a review of commodity prices used for impairment tests. It stated in the press release that ‘the potential for weaker demand for energy for a sustained period’ and ‘BP’s management also has a growing expectation that the aftermath of the pandemic will accelerate the pace of transition to a lower carbon economy and energy system, as countries seek to build back better so that their economies will be more resilient in the future...’ BP has soon thereafter successfully issued ~$12bn worth in hybrid bonds (>3x oversubscribed), which based on IFRS (as these are perpetual) is treated 100% equity, while rating agencies treat these 50/50 debt/equity (i.e., it will help with credit metrics). While hybrids come with higher yields than senior bonds, it is much better/cheaper option than, for example, an equity raise. And today, it announced the sale of the Petchem business for $5bn.

Bottom line, BP is moving step by step forward to reinvest itself. The macro environment is different to before (including BP’s changed view of the world), while its balance sheet is still not where it should be and the investment/capex levels currently guided to for 2020 (and early commentary recently on 2021 capex, which may go down further y/y) are too low to sustain the business nor scale up investments in low carbon businesses, in our view. The next major update should be 2Q20 results (i.e., the dividend is reviewed on a quarterly basis). Then after the summer break, BP will present its updated Strategy on 14-16th September.

UK construction and infrastructure stuff is up slightly, mostly, after Boris Johnson said on ham radio that he plans a doubling down on public investment and a "Rooseveltian" approach to the economy. Johnson had already frontrun his big speech due Tuesday by taking about spending on hospitals, schools and roads in an interview with the MoS (not Sunday Mail). Priti Patel used many of the same catchphrases when she did the rounds of the Sunday shows. Details are somewhat lacking of course, but so are the politicians.

Sterling’s back to a 13-week low versus the euro, meanwhile, which is probably more to do with Brexit than the UK’s reanimation of Rooseveltianism. EU-UK talks resume today. Here’s Berenberg:

Some signs of hope: Ongoing UK-EU negotiations for a comprehensive future relationship have turned more amicable of late. Although the UK has firmly refused to extend the transitional period beyond 31 December 2020, both sides are floating potential compromises that can unlock other areas of difference such as on governance, level playing field provisions and politically sensitive fisheries.

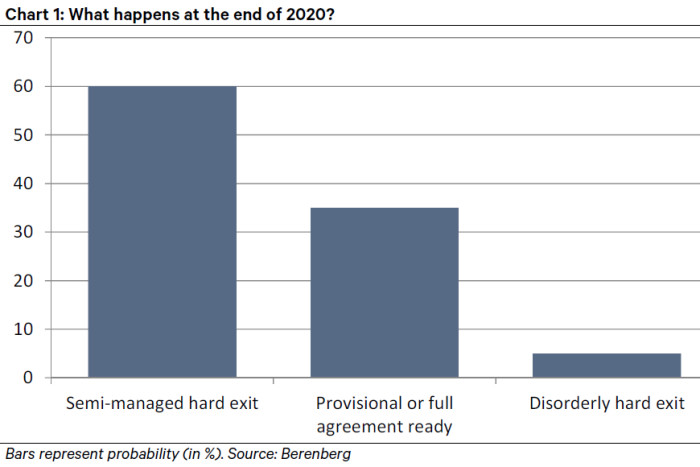

● Our base case remains unchanged: Despite signs of progress, we still do not expect a deal in time for the year-end. Instead, we expect the two sides to agree on some modest stopgap measures in order to prevent a disorderly hard exit. Instead of one big cliff edge, where the UK-EU economic relationship suddenly shifts from open single market rules to the much more restrictive World Trade Organisation rules for trade, we expect the two sides to see to it that the switch occurs in a series of smaller steps. We put a 60% probability on this outcome.

● Positively skewed risks: We no longer see a disorderly exit as the major risk – and most likely alternative – to our base case. Instead, we see a reasonable chance (35%) that the two sides can strike a deal worth its name before the end of the year. On the downside, we see a 5% tail-risk of a disorderly hard exit.

● Irish border – still the critical issue: Earlier this year, the UK government had stated that it would not perform checks on goods flowing between Great Britain and Northern Ireland, thereby violating the legal commitments it made in the Withdrawal Agreement that will prevent a hard border returning to the island of Ireland. However, more recently, things have taken a turn for the better. The UK now accepts that it will need to perform such checks. The progress on this critical issue seems to have helped to break the deadlock in other key areas.

● Politic context matters: While the pandemic has not affected the UK’s desire for a deal as much as is commonly perceived and the EU’s flexibility on what it can agree remains limited, there seems to be some scope for both sides to strike acceptable trade-offs in order to conclude a deal. Still, a lot has to go right for that to happen by the end of the year.

● Economic outlook: Our call for a tick-shaped recovery from the COVID-19 megarecession hinges on the UK avoiding a disorderly hard exit. In such an outcome, the UK could temporarily fall back into recession in early 2021. Conversely, a full or partial deal by the end of the year or in early 2021 would tilt the medium-term growth risks to our UK forecasts to the upside.

And Deutsche:

The passing of the June 30th deadline for an extension to the transition period would be a negative for the UK, though it is now firmly expected and priced in by the market judging by the fall in EURGBP risk reversals over the past few weeks. Companies will now likely be forced to trigger some form of no-deal contingency planning, weighing on business sentiment and UK data at a time when the government is trying to reopen the economy.

While the intensification of negotiations over July is in itself a positive and a sign of the greater optimism that now surrounds the talks, the bar for actual progress in the short-term is high. We believe there is scope for compromise on the key sticking points, though movement is likely to only come later in the year once the EU’s Recovery Fund negotiations have been completed. Indeed, it’s likely that EU member states may not spend political capital on intra-EU Brexit negotiations until the more economically important recovery fund is finalised. . . .

Though the UK has expressed a desire to complete a deal by the end of the summer, the bar for this remains high. With a deal also requiring time to be ratified, it may be that late October/early November becomes the real deadline for agreement. On balance, we still see a deal as more likely than not, with space for compromise in many of the key areas slowly emerging. A further political push for a deal will most likely need to come from both sides however, and the risk is this doesn’t come until the autumn. Going forward, we also expect increased focus on the potential for an implementation period to partially smooth any adjustment to new trading conditions.

Back to construction, and Balfour Beatty (which, full disclosure, once employed the author to crawl inside a room-sized architectural plan printer and locate paper jams) goes down to “hold” at Jefferies.

Construction sites continue to reopen and the strong US/UK order book should help reassure on the near-term outlook. Comments at the 1H20 results on any impacts on bidding terms and contract volumes will be key for FY21/22 earnings. We lower our estimates slightly to reflect FX changes, while our underlying estimates remain largely unchanged. However, with limited upside to our price target on c.15x P/E 2020E, we downgrade to Hold.

In May 83% of Construction sites were open and we expect this to have increased to >90% by the end of June (remainder largely sites in Scotland) and disruption from availability of labour or materials to have diminished since the May update. However, we still forecast 1H20 group sales down 22% yoy and earnings down 30% with no disposals from the investment portfolio.

HS2 should reduce pressure on order intake but market activity so far in 2H20 will be key. The order book as at 30 April was £17.4bn (vs £14.3bn in FY19), primarily due to the inclusion of >£3bn of HS2 contracts. The UK government's £600bn commitment to infrastructure outlined in the last Budget (over 5 years vs 10 years previously) and renewed focus on infra investment in the US bode well for mid-term topline growth. However, activity may continued to be suppressed if a prolonged recession emerges and public budgets are stressed (with a recent study by the BBC suggesting 148 UK local authorities (out of 173 surveyed) expect a budget shortfall).

Military housing clarity unlikely until later in the year. Following the by £69m/15% reduction in the Directors' valuation (DV) of the military housing assets at FY19, we do expect any further reductions at 1H20. We believe any further adjustments to the valuations, if appropriate, could occur in FY20 to reflect any full-year impact of military housing reforms enacted at the start of this year. We also expect the DoJ's investigation into handling of work orders to be an overhang into 2H20.

Avg net cash expected to decrease to June but balance sheet is still among the strongest in the sector. Balfour Beatty had £452m of net cash and £375m of undrawn facilities as at 27 May, and avg month-end net cash Jan-Apr was £464m. We expect this to have been fairly resilient in 1H20 aided by tax deferral benefits, albeit lower from May due to seasonality. We note that 1H20 cash will not yet reflect the £112m of preference shares being redeemed on 1 July. We retain our view that Balfour Beatty balance sheet strength backed by the group's £1.1bn infrastructure investment portfolio, leaves it among the best positioned contractors to weather mid-term market volatility. We forecast an avg month-end net cash position in FY20 of c.£190m, (from £324m at FY19).

Speaking of construction and Jefferies, its former housing analyst Anthony Codling is now CEO of Twindig and writes a highly recommended blog about the market. “Stay at home – don’t buy a home – protect your equity” features both in the intro and the conclusion so you can probably guess the gist of the middle.

UBS goes to “buy” on Reckitt Benckiser, £57 target, and switches down to “sell” on both Unilever and Danone. That’s after UBS’s various Evidence Lab surveys illustrated the “growing attractiveness of RB's categories” and further illustrated “the limited threat posed by private label in OTC as the vast majority of well-informed consumers continue to prefer branded products”:

Following 4 years (2016-19) of LFL sales growth deterioration during which [Reckitt] accumulated an extraordinarily high number of adverse one-offs, the company unveiled a new strategy at the start of this year. RB's comprehensive plan, aimed at realizing the full potential of its leading PowerBrands in attractive categories, has received an unexpected boost from the Coronavirus pandemic. As such, we expect RB to achieve sustainable 4-6% LFL and 7-9% EPS growth by 2022, 3 years ahead of the group's original plan. Growing relevance of the hygiene and health categories in a post Covid-19 world, dominant market share positions, large e-commerce operations, ambitious reinvestment programme and a rejuvenated organization underpin our confidence in the group's ability to meet its targets 3 years earlier than initially planned. We upgrade the stock to Buy as we believe RB’s superior earnings and LFL growth prospects relative to the Big 7 will drive a combination of LFL positive surprises and re-rating. . . .

We believe that the Covid-19 boost to the group's LFL will enable the company to invest an incremental £400m (twice the amount originally planned) this year behind commercial and digital capabilities and enhanced consumer service and value. RB's unmatched P&L flexibility is paving the way for fast improving market share momentum, notably in the 20% of its cells that have been persistent underperformers.

... and for Unilever, a €43/£40 target:

Based on our reverse DCF, we estimate that the stock now discounts a medium-term Underlying Sales Growth (USG) of nearly 4%. This is c. 1 percentage point above our own forecasts and thus, signals earnings downgrades risks, leaving the shares vulnerable to some de-rating. We believe that Unilever's muted USG performance actually goes back to 2014 and has been primarily attributable to slower penetration gains in emerging markets, persistent deflationary pressures in Western Europe and, more broadly, a less favorable channel footprint relative to peers. We see limited scope for significant operational improvement over the next 18 months and, as such, we are 5% and 7% below consensus at the 2020 and 2021 EPS estimates levels.

A modest contribution from the group's growth engine, a lower exposure than peers to e-commerce and limited P&L flexibility add to our concerns that the challenges faced by Unilever will take time and money to fix. Medium-term solutions do exist but would entail either a meaningful step-up in investments or a material portfolio transformation. We view Unilever's unification plan as a potential first step towards a reshuffling of the group's portfolio, but unlikely to yield significant changes over the next 12 months.

As for Danone, €58 target:

For close to a decade, Danone has been finding it challenging to achieve sustainable profit growth in its largest division of Essential Dairy & Plant-based products (EDP). Despite successive strategic shifts, large acquisitions and efficiency programs, profits in EDP have failed to reach their 2009-11 levels in recent years, signalling persistent structural issues, in our view. This lingering weakness has made Danone's operational performance increasingly reliant on the strength of its Specialized Nutrition division and of its Aquadrinks. With both growth engines slowing and the contribution from savings and synergies fading from 2020 onwards, we see downside risks to consensus estimates – 5% and 7% below consensus for 2021 and 2022, respectively. A rapid deterioration in the group's earnings growth momentum (from c. 8% p.a. in 2017-19 to less than 2% for the next four years, based on our estimates) will fuel further derating of Danone's shares, in our view.

And Capgemini’s a “take profits” at HSBC:

Good position in digital transformation validated: We have previously highlighted Capgemini as a beneficiary of the current trend of digital transformation of the economy . . .. Digital now represents over 50% (vs 38% in 2017) of the group revenues, growing at 20% (2019 and Q1 2020). We expect COVID-19-related lockdowns to continue to accelerate existing digitalisation trends and Capgemini should continue to benefit from its: (1) standardization to bring more agility (development of platforms, digital works place, cyber security), (2) more cloud, even for business critical applications (orchestration, partnerships with hyperscalers), and (3) more outsourcing, especially in manufacturing.

Lack of visibility creates more risks than opportunities at this stage: Despite strong growth sustained in Digital, organic top-line growth of the group slowed from 6.7% in Q2 2018 to 2% in Q1 2020 y-o-y. This implies an acceleration of the rate of decline of the legacy part of the business. We continue to believe in the growth of the Digital segment, but pressure on the legacy business could be accentuated by the current environment (lower volume, price pressure), and mute the recovery of global revenue growth of the group, especially in the frame of a longer and deeper economic slowdown in 2021e. In addition, Altran’s acquisition adds more cyclicality to the combined group (Altran generates 18% of the 2020e pro forma revenues) with positions in verticals that could be durably hurt by the current pandemic-led crisis (Automotive and Aeronautics represents 40% of its 2019 revenues).

More cautious on margin recovery profile: Capgemini will publish its H1 2020 results on 3 September, later than the 28 July initially announced, due to the longer publication cycle of Altran, consolidated at 100% since Q2 2020. This will give the management more visibility on the rest of the year. We believe in the resilience of the group, especially on margins, which should be helped by cost synergies related to the consolidation of Altran. However, we cut our EPS estimates by 1-5-8% for 2020- 21-22e, integrating a less optimistic view on margin recovery.

Downgrade to Hold (from Buy) and cut TP to EUR105 (from EUR110) on lower estimates: The share price has recovered 80% since lows reached in March 2020 and is now -4% YtD, outperforming the CAC 40 index (-16% YtD), validating the resilient profile of the group and opportunities brought by its position in digital transformation. But the valuation has now recovered to its historical average with EV/EBIT 11.4x and PER 15x 2021e, whereas the environment remains challenging. We do not see a particular catalyst that would support further durable re-rating above the average.

• Updates follow, influenced or otherwise by requests and complaints in the comment box. A number of AV Telegram group chats are also available.

Comments